Table of Content

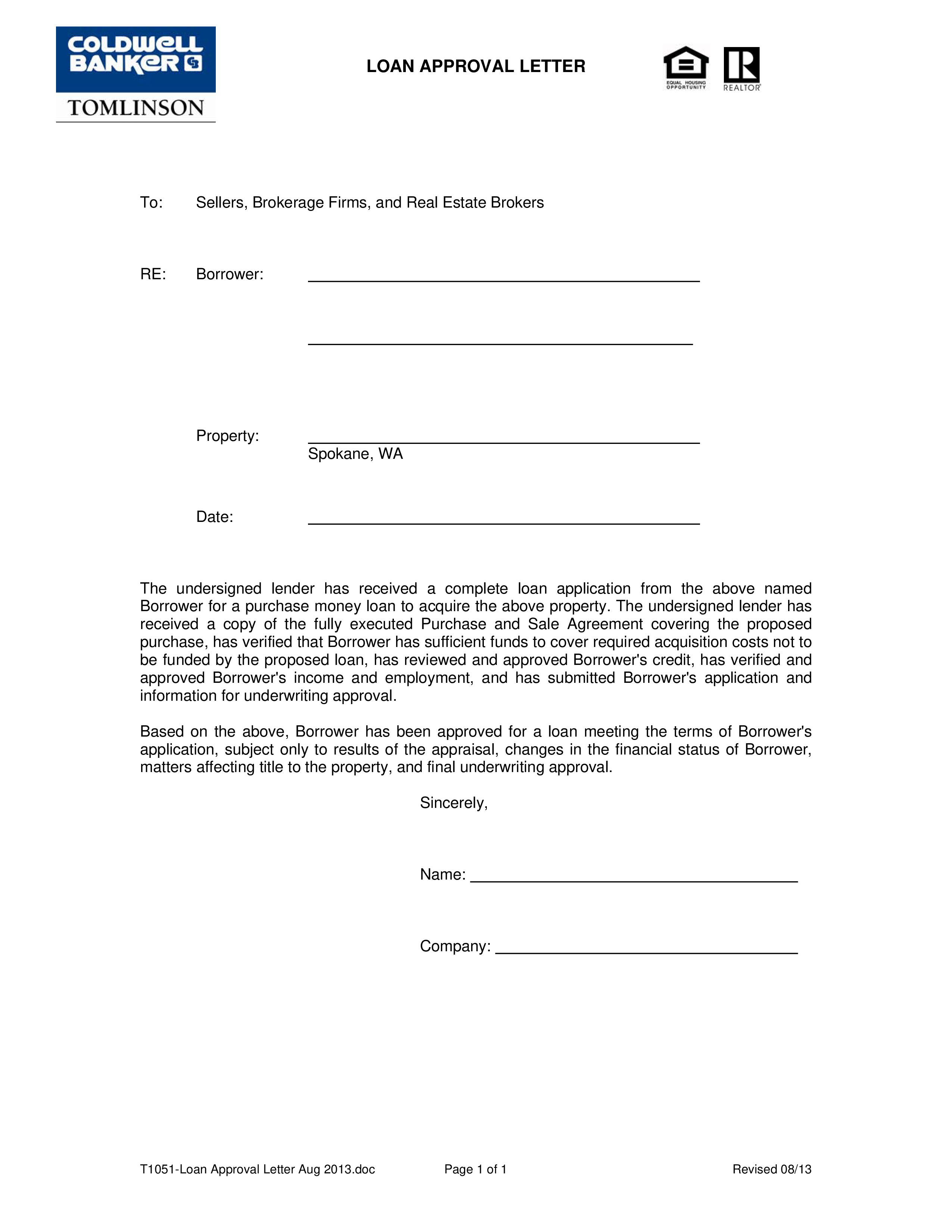

Did you know that you can submit your home loan application before you find the right property? It’s called pre-approval, also known as approval in principle or conditional approval. Pre-approval gives you an idea of how much you could afford to borrow and the total property price you can afford to pay. Depending on whether you work for an employer, are self-employed or if you receive income from other sources such as rental property, you’ll be asked to provide different documents to show your income. This could include recent payslips, bank statements showing salary credit, rental income statements and other proof of income.

Say your lender asks for two years of tax returns and you only provide one. Instead, it will ask you for that missing year of tax-return information. This all takes time, and can muck up the approval process. Connect with a local non-commissioned real estate agent to find out all the ways you can save. Communication mostly happens over the phone between buying and selling agents, so you’ll likely be waiting on your agent for the latest status updates. Once you hear back, you may have to negotiate back and forth on things like price, contingencies, and closing date until you come to an agreement with the seller.

Can You Afford To Move To A Bigger House?

Official interpretation of 9 Notification of action taken, ECOA notice, and statement of specific reasons. This is also when you’ll need to pay your closing costs, so come prepared with any required payments in hand. In order to process payments quickly and get you into your home, payments should be certified funds, such as a cashier’s check or wiring the funds directly to escrow a few days prior to closing. Before you sign on your new home, you’ll have a final chance to review the terms of your mortgage and an itemized list of your closing costs. Your closing disclosures will arrive three days before closing. While there’s no specific financial advantage to closing on a certain day of the week or month, some days are more popular than others.

If any further information or documentation is required, your Suncorp Bank Home Loan Specialist will let you know. Next, we'll run through the home loan contract with you in person - we want to help make sure everything is clear. Particularly with first home buyers, we like to go through it together line by line. We get a complete understanding of where you’re at and what your ultimate goals are. We will contact you every year to review your mortgage and check whether you have had any problems. The realtor.com® editorial team highlights a curated selection of product recommendations for your consideration; clicking a link to the retailer that sells the product may earn us a commission.

Student Loan Application Form

Around 80% of home loan approval delays are the result of missing documents. A bank trying to win over a customer has a strong incentive to guarantee approval before a certain date, even if it is unrealistic. This is particularly true for low-cost lenders or banks that are advertising an interest rate that is way below the rest of the market. Depending on the complexity of your loan, the turnover time for your application will be either 1-3 days or 4-7 days.

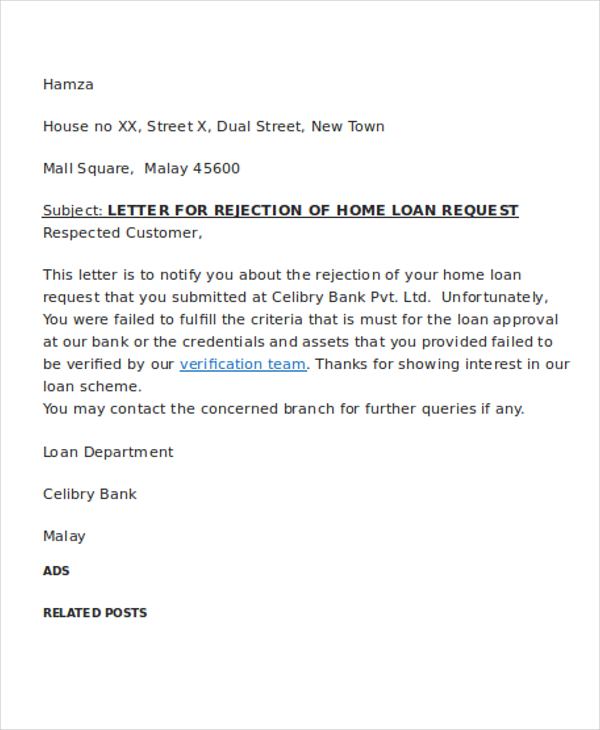

You don't have to wait until you find the perfect property before you begin the mortgage process. You can save time by starting the process to get pre-approved first. Your application may be denied for various reasons as having a low credit score or being ineligible for the loan you are applying for.

What Is An Appraisal Gap And How Does It Affect Your Mortgage?

You can apply for pre-approval as soon as you’re ready to start your property search, using any of the ways we’ve explained in Step 1. If your circumstances don’t change, pre-approval generally lasts for three months. If any of your circumstances change – such as your income, expenses, or type of employment – let us know as this may affect how much we can lend you.

If no credit is offered or if the applicant does not expressly accept or use the credit offered, each creditor taking adverse action must comply with this section, directly or through a third party. A notice given by a third party shall disclose the identity of each creditor on whose behalf the notice is given. If a creditor bases the denial or other adverse action on a credit scoring system, the reasons disclosed must relate only to those factors actually scored in the system. Moreover, no factor that was a principal reason for adverse action may be excluded from disclosure.

Construction Loan Documents

Greg West was great to work with as well as his processor Terra Dwyer. They were both in constant communication with me throughout the entire process from loan application to closing. I also received very quick responses to my e-mails regardless of the time of day.

During this stage, you don’t need to add any supporting information. An ANZ representative will then call you within 48 hours. The representative will help take your application forward, including assessing all relevant information, documentation and conducting a credit check. If the seller accepts your offer, then you’ll sign a purchase agreement, and your lender will order a home appraisal. The appraisal is different from a home inspection, and it’s a requirement for USDA loan approval. Depending on your situation, USDA loan approval can take several weeks to over a month — generally, days.

We’ve all seen commercials from mortgage lenders who promise to make the application process easier. But just because you can submit a loan application with the press of your computer’s “Return” key doesn’t mean that your approval will be coming in any faster. Prequalification with a USDA-approved lender is an important first step in the loan application process.

Credit Application FormA credit application form is used in financial institutions to collect information about potential borrowers for loans, credit cards, and other such products. Consumer Loan ApplicationApprove loan applications in an organized manner by using this Consumer Loan Application form template where the applicants can fill-up the form and send the data directly to your database. Mortgage Loan ApplicationBanks and moneylenders can use this free Mortgage Loan Application Form to accept loan applications online. Once your completed application is submitted, all the information you’ve provided will be verified to ensure that it meets Suncorp Bank requirements. If you’ve been as accurate as you can, this stage should be pretty painless. Home Loan Experts has a commitment to getting the right home loan for your needs and this has helped us earn multiple industry and consumer awards.

Once these conditions have been met, you’ll receive notice of your approval outcome from your Suncorp Bank Home Loan Specialist. We will be in touch with you after two weeks to make sure you understand the terms of the mortgage and how to make repayments. We’ll also ask for a copy of the settlement letter to confirm that the lender has not overcharged you. “The best advice I can give someone buying a home is to prepare to respond very quickly for any and all documentation requests,” Fite says.

For that reason, before acting on the advice, you should consider the appropriateness of the advice having regard to your own objectives, financial situation and needs. Where the advice relates to the acquisition, or possible acquisition, of a particular financial product, you should consider the Product Disclosure Statement before making any decision regarding the product. When the contract is received and all the requirements are met, the loan application will proceed to settlement. If your loan is formally approved, Suncorp Bank will send you your home loan contract. This should be thoroughly checked, with a second (or third!) set of eyes on it if you need them, before being signed and returned as soon as possible. After these checks, Suncorp Bank will confirm any applicable conditions on the loan, such as a requirement that the property be insured.

You’ve been thinking about buying a home for months—maybe even years. Now that you’re ready, you’re probably wondering how long it will take until you get to pick up the keys. Of course, the time it takes to find a home you love is going to vary, but the average timeline to close a mortgage is just 42 days. At Better Mortgage, our modern online process makes it even faster; our average closing time is just 32 days. The time between getting formal approval and signing the contract of sale will come down to how organised you and the vendor are.

No comments:

Post a Comment